Market Insights

Independent resources and insights for buyer, sellers and business operators in the financial services industry

Market Commentaries

Market CommentariesMarket Commentary 2024

https://www.youtube.com/watch?v=oSnb-3k_QbA You can view the full Market Commentary by clicking the button below. Market Commentary 2024 We are pleased to announce the release of Forte…

Market Commentaries

Market CommentariesSequoia’s PD Day

Steve Prendeville sits down with Garry Crole to discuss the general overview of the industry and provide a market update. Steve also delves into his…

Market Commentaries

Market Commentaries20 years of selling and valuing financial services businesses

https://www.youtube.com/watch?v=e8MpjvRXIUM Forte Asset Solutions' Managing Director has just celebrated his 20th year anniversary of selling and valuing Financial Services businesses. Please find a brief message…

Market Commentaries

Market CommentariesA review of 2021 – Market Commentary

You can view the full Market Commentary by clicking the button below. Market Commentary 2021 2021, a year Our industry and growing profession continued to…

Market Commentaries

Market CommentariesM & A Trends and Selling for Top Dollar

https://youtu.be/3OciIerO7lk 2021 PIFA Symposium ~ Steve Prendeville In a 90 minute presentation given at the 2021 PIFA symposium, Steve Prendeville discusses the most recent market…

Market Commentaries

Market CommentariesOUTLOOK FOR ADVICE PRACTICE VALUES IN 2021

2020 was a rocky year for practice valuations, with AMP’s landmark decision to revalue its BOLR terms having a butterfly effect through the market while thousands…

Market Commentaries

Market Commentaries‘Vanilla’ AFSL prices surge as advisers disperse

“They used to have no value,” Prendeville says. “Now the average value is probably close to $70,000 and I have a waiting list.” Advice merger…

Market Commentaries

Market CommentariesMarket Update – Valuations in a pandemic

https://youtu.be/qMeCWWc98Do Valuations in a pandemic: Full Report Below What a difference a week, a month and a year can make. Early March I was on…

Market Commentaries

Market Commentaries2018/2019 Financial Year Market Commentary

[vc_row][vc_column][vc_video link="https://youtu.be/QsqMCXS1Too" video_title="1"][vc_column_text] 2018/2019 Financial Year: Following the shocking revelations of the Royal Commission, the landscape of the financial services industry is forever changed. In…

Market Commentaries

Market Commentaries2017/2018 Financial Year Market Commentary

[vc_row][vc_column][vc_video link="https://www.youtube.com/watch?v=NK6Kyiaupns" video_title="1"][vc_column_text css=".vc_custom_1538911677973{margin-top: 25px !important;}"] This financial and calendar year 2018 will be forever marked by the Royal Commission. [/vc_column_text][vc_column_text css=".vc_custom_1538912901869{margin-top: 25px !important;}"]Forte made…

Market Commentaries

Market CommentariesSpecial Market Commentary Post Royal Commission

I watched the spectacle of the Royal Commission into the Misconduct into the Banking, Superannuation and Financial Services Industry (RC) via live streaming. It felt…

Market Commentaries

Market CommentariesIssue #11 : Market Commentary Financial Year 2017

Market Commentary 2017 YTD Background The ASX 200 rose 9.3% for the 2016/17 Financial Year. Since the Global Financial Crisis only 2013 (17.3%) and 2014…

Market Commentaries

Market CommentariesIssue #10 : Market Commentary Financial Year 2016

Market Commentary 2016 YTD Industry Overview The prevalent theme over the year has been one of compliance. This is the continued over hang from the…

Market Commentaries

Market CommentariesIssue #9 : Market Commentary Financial Year 2015

Market Commentary 2015 YTD Forte normally takes a rolling 12 month period to identify market trends but the 2015 YTD is so unusual and trends…

Market Commentaries

Market CommentariesIssue #8 : Market Commentary Financial Year 2014

2013 finished with a whimper, however, with a message of hope when the new government's spokesman Arthur Sinodinos made comments indicating delivery of pre- election…

Market Commentaries

Market CommentariesIssue #7 : Market Commentary Financial Year 2013/2014

An artificial Merger and Acquisition freeze was created in Financial Services and the wider community due to political and legislative uncertainty through the period from…

Market Commentaries

Market CommentariesIssue #6 : Market Commentary for the Calender Year 2013 and Trend Identification for 2014 and beyond

Forte Asset Solutions The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning…

Market Commentaries

Market CommentariesIssue #5 : 2012/13 Financial Year Market Commentary

Forte Asset Solutions The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning…

Market Commentaries

Market CommentariesWeak supply boosting valuations: Prendeville

Author: Tim Stewart Financial planning practice valuations have returned to three times recurring revenue as weak supply fails to meet demand, according to Forte Asset…

Market Commentaries

Market CommentariesIssue #4 : 2012 Calendar Year Review

Forte Asset Solutions The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning…

Market Commentaries

Market CommentariesIssue #3 – Market Commentary

Forte Asset Solutions The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning…

Market Commentaries

Market CommentariesIssue #2 – Market Commentary

Forte Asset Solutions The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning…

Market Commentaries

Market CommentariesIssue #1 – Introducing Forte Asset Solutions

Introducing Forte Asset Solutions Forte has retained the database of Kenyon Prendeville and all previous registered buyers information has been maintained to provide ongoing service…

Multiples Table

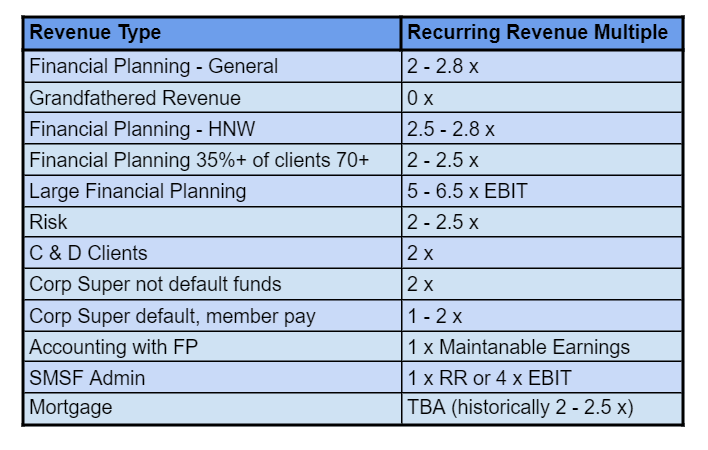

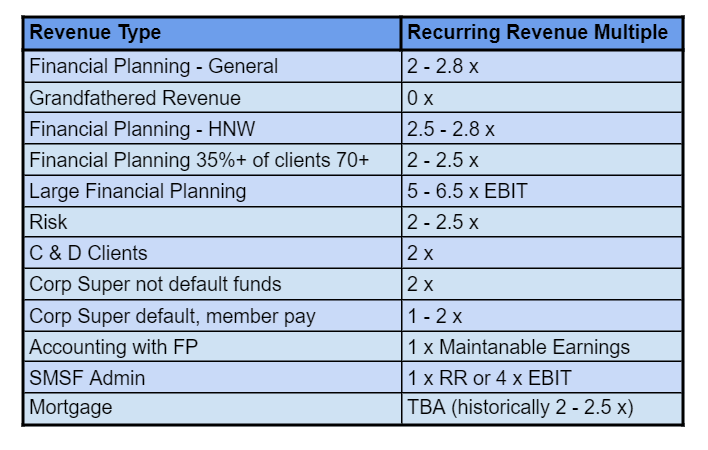

Multiples TablePrice Guide – December 2021

There are a number of variables which help attribute to the valuation multiple of a […]

Multiples Table

Multiples TablePrice Guide – April 2021

In a time where there is so much uncertainty, businesses that can showcase predictability and […]

Buyer Tips

Buyer TipsSequoia’s PD Day

Steve Prendeville sits down with Garry Crole to discuss the general overview of the industry […]

Buyer Tips

Buyer TipsM & A Trends and Selling for Top Dollar

In a 90 minute presentation given at the 2021 PIFA symposium, Steve Prendeville discusses the […]

Buyer Tips

Buyer TipsBuying a Financial Planning Practice: Tips for a buyer

DEVELOP A BUYING STRATEGY Create a clear written strategy including what you want and why, […]

Buyer Tips

Buyer TipsElephant in the room Why do financial planning businesses trade at higher multiples than accounting firms?

My last IFA contribution (September 2014) looked at external factors that impact industry valuations. I skirted the elephant in the room – that is, the application of recurring revenue and/or EBIT and the more controversial question of why accounting firms trade at one times and financial planning practices trade at three times.

Buyer Tips

Buyer TipsMomentum builds for EBIT valuations

As a broker of advisory practices, I was keenly interested in Rod Bertino’s article on valuations in last week’s Reality Check. My recent experience in the marketplace affirms Rod’s research findings that EBIT valuations are in fact outperforming recurring revenue valuations.

Seller Tips

Seller TipsM & A Trends and Selling for Top Dollar

In a 90 minute presentation given at the 2021 PIFA symposium, Steve Prendeville discusses the […]

Seller Tips

Seller TipsSell Your Financial Planning Business: Tips for a seller

PREPARING YOUR BUSINESS FOR SALE In our initial meetings we discuss market values, the sales […]

Seller Tips

Seller TipsElephant in the room Why do financial planning businesses trade at higher multiples than accounting firms?

My last IFA contribution (September 2014) looked at external factors that impact industry valuations. I skirted the elephant in the room – that is, the application of recurring revenue and/or EBIT and the more controversial question of why accounting firms trade at one times and financial planning practices trade at three times.

Seller Tips

Seller TipsLegacy the key to practice valuation

The most important element of advice practice valuation is the legacy the business leaves behind, says Forte Asset Solutions director Steve Prendeville.

Seller Tips

Seller TipsMomentum builds for EBIT valuations

As a broker of advisory practices, I was keenly interested in Rod Bertino’s article on valuations in last week’s Reality Check. My recent experience in the marketplace affirms Rod’s research findings that EBIT valuations are in fact outperforming recurring revenue valuations.

Seller Tips

Seller TipsThe 3 keys to getting the best price for your practice

In No More Practice 4, Jim Taggart is on a journey to maximise his earn out following the sale of his practice to Austbrokers. A key part of my role in the show involves brokering the deal and advising Jim along the way as he seeks to maximise his earn out.

Case Studies

Case StudiesMaximising the value of your advice practice

Hear from Steve Prendeville, Founder and Managing Director of Forte Asset Solutions, as he […]

Case Studies

Case StudiesRedesigning a practice

A case study of how one practice implemented managed accounts, increased efficiency, and created value for their clients.

Case Studies

Case StudiesLegacy the key to practice valuation

The most important element of advice practice valuation is the legacy the business leaves behind, says Forte Asset Solutions director Steve Prendeville.

Case Studies

Case StudiesBuilding a profitable business

"Hope is not a strategy." This is how veteran practice consultant, Jim Stackpool from Strategic Consulting and Training, sums up the situation facing financial planners in the brave new FoFA, post-GFC world.

Presentations and Webinars

Presentations and WebinarsPODCAST: How to navigate challenges and seize the opportunities

In the latest episode of the ifa Show, host Maja Garaca Djurdjevic sits down with […]

Presentations and Webinars

Presentations and WebinarsThe GAF Podcast – Episode 33 with Steve Prendeville

In this podcast Scott chats with Founder and Director of Forte Asset Solutions Pty Ltd, […]

Presentations and Webinars

Presentations and WebinarsIFA Podcast: Why storm clouds will part for advice in 2023

In this episode of the ifa podcast, host Maja Garaca Djurdjevic is joined by founder […]

Presentations and Webinars

Presentations and WebinarsM & A Trends and Selling for Top Dollar

In a 90 minute presentation given at the 2021 PIFA symposium, Steve Prendeville discusses the […]

Presentations and Webinars

Presentations and WebinarsPraemium – Advice for Business Valuations

What is the outlook for buyers and sellers of advice practices over the next 5 […]

Presentations and Webinars

Presentations and WebinarsNavigate your way to a strong business valuation

With the changes experienced by business owners through COVID and the continuing legislative pressure, it’s […]

Presentations and Webinars

Presentations and WebinarsAdvice business valuations, succession planning & more

Praemium’s Head of Distribution Martin Morris talks to Steve Prendeville of Forte Asset Solutions, a […]

Presentations and Webinars

Presentations and WebinarsOUTLOOK FOR ADVICE PRACTICE VALUES IN 2021

2020 was a rocky year for practice valuations, with AMP’s landmark decision to revalue its […]

Presentations and Webinars

Presentations and Webinars‘IT’S BEEN A DROUGHT’: WHY DEMAND FOR ADVICE FIRMS IS RUNNING HOT

Contrary to popular belief, the adviser exodus has not led to a flood of practices […]

Presentations and Webinars

Presentations and WebinarsBusiness Profitability, Valuations and Regulatory Environment

Steve Prendeville joins the CEO of Shartru Wealth Management, Robert Coyte. They talk about a […]

Presentations and Webinars

Presentations and WebinarsAIOFP Presentation

Practice Valuations during a pandemic Steve Prendeville: 17:23 – 34:41

Presentations and Webinars

Presentations and WebinarsMaximising the value of your advice practice

Hear from Steve Prendeville, Founder and Managing Director of Forte Asset Solutions, as he […]

Presentations and Webinars

Presentations and WebinarsHow technology is enabling the financial planning industry to provide real value and increase client engagement

Forte Asset Solutions Managing Director, Steve Prendeville, sat down with the National Business Developer […]

Presentations and Webinars

Presentations and WebinarsUnlocking Practice value with Managed Portfolios

HUB24 Head of Managed Portfolios Brett Mennie discusses with Forte Asset Solutions Managing Director Steve […]

Presentations and Webinars

Presentations and WebinarsForte’s Steve Prendeville in the hugely successful “No More Practice” reality TV show

Forte’s Steve Prendeville recently participated in the hugely successful “ No More Practice” produced by Evo TV. The programme featured on Sky Business and followed the journey of one of Forte’s clients Jim Taggart of the Taggart group post the selling of his business.

Articles and Media

Articles and MediaMarket Commentary 2024

You can view the full Market Commentary by clicking the button below. We are pleased […]

Articles and Media

Articles and MediaAdvisers challenged by capacity, shrinking talent pool

While there is renewed confidence in advice, businesses are at full capacity while facing talent […]

Articles and Media

Articles and MediaPODCAST: How to navigate challenges and seize the opportunities

In the latest episode of the ifa Show, host Maja Garaca Djurdjevic sits down with […]

Articles and Media

Articles and MediaThe GAF Podcast – Episode 33 with Steve Prendeville

In this podcast Scott chats with Founder and Director of Forte Asset Solutions Pty Ltd, […]

Articles and Media

Articles and MediaIFA Podcast: Why storm clouds will part for advice in 2023

In this episode of the ifa podcast, host Maja Garaca Djurdjevic is joined by founder […]

Articles and Media

Articles and Media‘The quality of advice has never been better’

Despite the cloud of negativity that descended on the financial advice industry several years ago, […]

Articles and Media

Articles and Media‘Well on our way’ to bridging advice trust deficit

“We’re well on our way to bridging the trust deficit in advice with the exit […]

Articles and Media

Articles and MediaWhy are Advisers Holding off Selling up?

“There is expected to be an increase in merger activity in the adviser businesses within […]

Articles and Media

Articles and MediaA review of 2021 – Market Commentary

You can view the full Market Commentary by clicking the button below. 2021, a year […]

Articles and Media

Articles and MediaMental Health Survey Findings

The changes over the last three years have created a high level of stress within […]

Articles and Media

Articles and MediaThe Future of the Australian Financial Adviser

In a 7 part Expert Interview series, Forte’s principle Steve Prendeville joins Russell Pearson from […]

Articles and Media

Articles and MediaNavigate your way to a strong business valuation

With the changes experienced by business owners through COVID and the continuing legislative pressure, it’s […]

Articles and Media

Articles and MediaOUTLOOK FOR ADVICE PRACTICE VALUES IN 2021

2020 was a rocky year for practice valuations, with AMP’s landmark decision to revalue its […]

Articles and Media

Articles and Media‘Vanilla’ AFSL prices surge as advisers disperse

“They used to have no value,” Prendeville says. “Now the average value is probably close […]

Articles and Media

Articles and MediaWealth industry headed for supermarkt style duopoly

“It is the most significant disruption and structural change in the history of the industry,” […]

Articles and Media

Articles and MediaIOOF misses bank exodus opportunity

“The movement is away from the largest dealer groups to the smaller independent boutiques, and […]

Articles and Media

Articles and MediaSpin-off firms a difficult option, says Prendeville

With more instos expected to exit the advice space, the option for aligned advisers to branch out together like Crestone Wealth Management would be “extremely difficult” to execute, says Steve Prendeville, director of Forte Asset Solutions.

Articles and Media

Articles and Media‘Brand damage’ leading to bank exit, says consultant

The wealth arms at major banks have endured “substantial brand damage” over the years, which is one of the key reasons some are exiting the advice space, says business consultant Steve Prendeville.

Articles and Media

Articles and MediaNetwealth gets ‘significant’ buyer interest for Pathway

Netwealth has engaged business consultant Steve Prendeville to sell its Pathway compliance business, which has already received “significant” interest from potential buyers.

Articles and Media

Articles and MediaGame over for insto-aligned advice

The revelation that NAB has assisted aligned practices to obtain their own AFSLs is welcome news. But it also proves the jig is up for institutional control of Australia's advice practices.

Articles and Media

Articles and MediaNon-aligned licensees face ‘Trojan horse’ danger

The migration of advice practices from institutional to non-aligned channels presents a specific challenge alongside the opportunities, says an industry analyst and expert.

Articles and Media

Articles and MediaOpportunities and challenges in independent exodus

The year ahead will test the mettle of non-aligned dealer groups looking to cash in on the migration of advisers away from the institutional sector.

Articles and Media

Articles and MediaForte Dealer Solutions names new director

A former senior manager within the IOOF financial advice network has joined Steve Prendeville’s dealer services consultancy to help match advisers to appropriate licensees.

Articles and Media

Articles and MediaMid-tier dealers lack crucial capital, says analyst

The migration of advisers to mid-tier non-aligned dealer groups is an opportunity they may be ill-equipped for, says M&A consultant Steve Prendeville.

Articles and Media

Articles and MediaFleeing insto advisers bypass mid-tier

Advisers leaving major institutions to join the non-aligned space are bypassing mid-tier dealer groups, which struggle to maintain an independent culture as they grow, an industry analyst has said.

Articles and Media

Articles and MediaAustralian advisers unprepared for exit

Research from American consulting firm Cerulli Associates has found US advisers are underprepared for their retirement, but an expert cautions that the situation is worse in Australia.

Articles and Media

Articles and MediaForeign ownership of financial services

On the sidelines of the AIOFP conference in Tokyo, Japan, M&A consultant Steve Prendeville joins The ifa Show to chat about the increasing influence of foreign buyers in Australian financial services. We discuss some major recent deals, ones on the horizon and the impact for advisers and licensees. We also speak with Malcolm Whitten of Nikko Asset Management about the strategy behind the Nikko AM Australian Share Income Fund.

Articles and Media

Articles and MediaPrivate equity players back Fitzpatricks

Financial advice network Fitzpatricks Group has received capital funding from two private equity investors, leading one analyst to tip further deal activity of this kind.

Articles and Media

Articles and MediaFinancial services set for turbulent 2015 – January 9th 2015

The financial services landscape will alter significantly in 2015 as offshore interests and domestic private equity players establish themselves, predicts a business broker and consultant. Speaking to InvestorDaily, Forte Asset Solutions managing director Stephen Prendeville – who is the former chief executive of Deloitte Financial Services – said the primary trend throughout the year will be a "mass movement" away from institutionally owned dealer groups.

Articles and Media

Articles and MediaElephant in the room Why do financial planning businesses trade at higher multiples than accounting firms?

My last IFA contribution (September 2014) looked at external factors that impact industry valuations. I skirted the elephant in the room – that is, the application of recurring revenue and/or EBIT and the more controversial question of why accounting firms trade at one times and financial planning practices trade at three times.

Articles and Media

Articles and MediaLegacy the key to practice valuation

The most important element of advice practice valuation is the legacy the business leaves behind, says Forte Asset Solutions director Steve Prendeville.

Articles and Media

Articles and MediaAdvice Practice Values Normalise: Forte

Financial advice practice valuations have returned to their long-term average of three times recurring revenue, says Forte Asset Solutions director Steve Prendeville.

Articles and Media

Articles and MediaBroker groups to buy into wealth sector

An M&A consultant is seeing increasing interest from large broker groups eager to acquire financial planning businesses.

Articles and Media

Articles and MediaPrendeville acquires dealer group consultancy

My Dealer Group director Anne Fuchs has been recruited to a full-time position at the AFA, with M&A consultant Steve Prendeville taking over her licensee matchmaking business.

Articles and Media

Articles and MediaIFA July 2014 – The times they are a changin’

The industry is evolving and savvy operators need to ride the waves of change to maximise the value of their business

Articles and Media

Articles and MediaSMSF Audit pricing under threat

Accountants will need to move to protect their role in the SMSF sector as auditors come under threat from new technology solutions, according to industry consultant Steve Prendeville.

Articles and Media

Articles and MediaIt’s a buyers market as big guns wind back

"It's the first time in 10 years I've seen an absence of buyers" says Stephen Prendeville, managing director of specialist financial planning practice broker Forte Asset Solutions.

Articles and Media

Articles and MediaMomentum builds for EBIT valuations

As a broker of advisory practices, I was keenly interested in Rod Bertino’s article on valuations in last week’s Reality Check. My recent experience in the marketplace affirms Rod’s research findings that EBIT valuations are in fact outperforming recurring revenue valuations.

Articles and Media

Articles and MediaDawn of age of consolidation for financial planners

The revolution reshaping financial services has already produced 10 major takeovers worth more than $14.5 billion, involving thousands of financial advisers and hundreds of billions in funds under management. Reform critics claim it has abandoned more than 30 years of improved consumer choice by sacrificing advisers, created barriers to entry and surrendered more power to the big banks and other powerful conglomerates.

Articles and Media

Articles and MediaThe competitive edge: 10 ideas to help practices survive and thrive

Although competition and change can be a threat, they also bring opportunities. Last month, Financial Planning explored the many challenges buffeting the planning industry. While the outlook was sobering, there are still many causes for optimism.

Articles and Media

Articles and MediaLike moths to a flame: Facing up to the competition

While they might not be donning running shoes and doing sprint trials, many financial planners probably feel their life is almost as competitive as that of a professional athlete.

Articles and Media

Articles and MediaAdvice M&A to increase

Merger and acquisition activity across Australia's practice and listed advisory sectors is expected to significantly increase this year with buoyant markets enticing advice principals and new entrants to seize opportunities.

Articles and Media

Articles and MediaPractice sales increasing as confidence improves

Older planners who have been deferring their retirement plans are putting their businesses up for sale as markets improve, according to Forte Asset Solutions director Stephen Prendeville.

Articles and Media

Articles and MediaLife moves beyond blue for pressured planners

The prolonged lull in investments markets, coupled with the pressure to comply with the new regulatory regime, is taking its toll on some financial planners' mental health.

Articles and Media

Articles and MediaVolume bans generate creative thinking

Non-aligned dealer groups that are not currently also product manufacturers will need to think creatively to deal with a revenue black hole caused by the removal of volume rebates, according to compliance experts.

Articles and Media

Articles and MediaInstos may face retention challenge in strong markets

Financial advisers who are viewing institutions as a "safe port in the storm" may be tempted to venture back to a boutique or non-aligned business model when we eventually return to a growth or bull market, according to the Forte Asset Solutions director Steve Prendeville.

Articles and Media

Articles and MediaBuilding a profitable business

"Hope is not a strategy." This is how veteran practice consultant, Jim Stackpool from Strategic Consulting and Training, sums up the situation facing financial planners in the brave new FoFA, post-GFC world.

Articles and Media

Articles and MediaFinancial planners punt on volume rebates

A perception that volume rebates from product issuers to dealer groups will be allowed "in some shape or form" led to a turnaround in practice values at the end of last year, according to Forte Asset Solutions director Stephen Prendeville.

Articles and Media

Articles and MediaStressed advisors sell client books

Financial stress and fears about wide ranging regulatory changes have contributed to a doubling of advisers putting their business up for sale during the past 12 months.

Articles and Media

Articles and MediaFOFA could increase financial planning practice sales further

There has been unprecedented activity over the past 12 to 18 months in terms of practice sales, and it is possible the clarity provided by the latest Future of Financial Advice (FOFA) announcements could prompt a further pick-up leading into the 1 July 2012 implementation date.

Articles and Media

Articles and MediaBusiness loan approval tightens

Planning practices looking to expand are finding it increasingly difficult to source funding, as banks tighten their lending criteria amid economic and regulatory uncertainty.

Articles and Media

Articles and MediaBusiness Valuation in a FOFA regime – 2011 Extract Market Commentary

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu. Steve was the founding partner of Kenyon Prendeville in 2003 and in May 2011 Steve sought to evolve the business model to the next level and created Forte Asset Solutions.

IFA Excellence Awards 2024

Hey everyone, I’m thrilled to announce that I have the pleasure of assisting ifa with […]

Market Commentary 2024

You can view the full Market Commentary by clicking the button below. We are pleased […]

Sequoia’s PD Day

Steve Prendeville sits down with Garry Crole to discuss the general overview of the industry […]

Advisers challenged by capacity, shrinking talent pool

While there is renewed confidence in advice, businesses are at full capacity while facing talent […]

PODCAST: How to navigate challenges and seize the opportunities

In the latest episode of the ifa Show, host Maja Garaca Djurdjevic sits down with […]

‘Greatest change the industry has ever seen’: Five years on from the RC

Half a decade has passed since the conclusion of the damning Hayne royal commission and […]

Super Boutiques and the golden age of advice

In this episode of the ifa Show, host Keith Ford is joined by Steve Prendeville, […]

Advice industry seeing ‘more tailwinds than headwinds’

For the first time in years, the financial advice market is seeing tailwinds rather than […]

Rise of Super boutiques to redefine advice, says professional

An industry professional predicts the proliferation of merger activity and the birth of “super boutiques” […]

Understanding the Levelling Off of PI Insurance Prices in 2023

Join Steve Prendeville and Jared Timms in this informative video as they discuss the intriguing […]

The GAF Podcast – Episode 33 with Steve Prendeville

In this podcast Scott chats with Founder and Director of Forte Asset Solutions Pty Ltd, […]

20 years of selling and valuing financial services businesses

Forte Asset Solutions’ Managing Director has just celebrated his 20th year anniversary of selling and […]

IFA ARTICLE ~ “ASIC levy another ‘nail in the coffin’ for advice businesses”

It is not clear yet whether the increase to the ASIC levy for advisers will […]

IFA Podcast: Why storm clouds will part for advice in 2023

In this episode of the ifa podcast, host Maja Garaca Djurdjevic is joined by founder […]

‘The quality of advice has never been better’

Despite the cloud of negativity that descended on the financial advice industry several years ago, […]

‘Well on our way’ to bridging advice trust deficit

“We’re well on our way to bridging the trust deficit in advice with the exit […]

Why are Advisers Holding off Selling up?

“There is expected to be an increase in merger activity in the adviser businesses within […]

A review of 2021 – Market Commentary

You can view the full Market Commentary by clicking the button below. 2021, a year […]

Mental Health Survey Findings

The changes over the last three years have created a high level of stress within […]

M & A Trends and Selling for Top Dollar

In a 90 minute presentation given at the 2021 PIFA symposium, Steve Prendeville discusses the […]

Price Guide – December 2021

There are a number of variables which help attribute to the valuation multiple of a […]

The Future of the Australian Financial Adviser

In a 7 part Expert Interview series, Forte’s principle Steve Prendeville joins Russell Pearson from […]

Praemium – Advice for Business Valuations

What is the outlook for buyers and sellers of advice practices over the next 5 […]

How can practices boost lagging profits?

Current average profit levels in adviser practices are drastically below what is needed for them […]

A review of 2020 – Market Commentary

2020 a year that will forever be in the global collective consciousness for the social, […]

Navigate your way to a strong business valuation

With the changes experienced by business owners through COVID and the continuing legislative pressure, it’s […]

Advice business valuations, succession planning & more

Praemium’s Head of Distribution Martin Morris talks to Steve Prendeville of Forte Asset Solutions, a […]

Price Guide – April 2021

In a time where there is so much uncertainty, businesses that can showcase predictability and […]

OUTLOOK FOR ADVICE PRACTICE VALUES IN 2021

2020 was a rocky year for practice valuations, with AMP’s landmark decision to revalue its […]

‘IT’S BEEN A DROUGHT’: WHY DEMAND FOR ADVICE FIRMS IS RUNNING HOT

Contrary to popular belief, the adviser exodus has not led to a flood of practices […]

Sell Your Financial Planning Business: Tips for a seller

PREPARING YOUR BUSINESS FOR SALE In our initial meetings we discuss market values, the sales […]

Buying a Financial Planning Practice: Tips for a buyer

DEVELOP A BUYING STRATEGY Create a clear written strategy including what you want and why, […]

‘Vanilla’ AFSL prices surge as advisers disperse

“They used to have no value,” Prendeville says. “Now the average value is probably close […]

Business Profitability, Valuations and Regulatory Environment

Steve Prendeville joins the CEO of Shartru Wealth Management, Robert Coyte. They talk about a […]

Wealth industry headed for supermarkt style duopoly

“It is the most significant disruption and structural change in the history of the industry,” […]

AIOFP Presentation

Practice Valuations during a pandemic Steve Prendeville: 17:23 – 34:41

Maximising the value of your advice practice

Hear from Steve Prendeville, Founder and Managing Director of Forte Asset Solutions, as he […]

How technology is enabling the financial planning industry to provide real value and increase client engagement

Forte Asset Solutions Managing Director, Steve Prendeville, sat down with the National Business Developer […]

Unlocking Practice value with Managed Portfolios

HUB24 Head of Managed Portfolios Brett Mennie discusses with Forte Asset Solutions Managing Director Steve […]

Market Update – Valuations in a pandemic

Valuations in a pandemic: Full Report Below What a difference a week, a month and […]

IOOF misses bank exodus opportunity

“The movement is away from the largest dealer groups to the smaller independent boutiques, and […]

2018/2019 Financial Year Market Commentary

Following the shocking revelations of the Royal Commission, the landscape of the financial services industry is forever changed. In

Redesigning a practice

A case study of how one practice implemented managed accounts, increased efficiency, and created value for their clients.

2017/2018 Financial Year Market Commentary

The exploratory themes of this paper are: The immediate impact of the Royal Commission, the continuing and accelerating adviser migrations, Dover Financial planning demise, FASEA and their impact on the industry, grandfathered revenue, recent transactions, current valuations, the future.

Special Market Commentary Post Royal Commission

I watched the spectacle of the Royal Commission into the Misconduct into the Banking, Superannuation and Financial Services Industry (RC) via live streaming. It felt like I was watching an episode of Game of Thrones with shocking revelations and blood everywhere. It is only post the shock that we have had the time to digest and think about the ramifications of what we have just witnessed.

Forte’s Steve Prendeville in the hugely successful “No More Practice” reality TV show

Forte’s Steve Prendeville recently participated in the hugely successful “ No More Practice” produced by Evo TV. The programme featured on Sky Business and followed the journey of one of Forte’s clients Jim Taggart of the Taggart group post the selling of his business.

Spin-off firms a difficult option, says Prendeville

With more instos expected to exit the advice space, the option for aligned advisers to branch out together like Crestone Wealth Management would be “extremely difficult” to execute, says Steve Prendeville, director of Forte Asset Solutions.

‘Brand damage’ leading to bank exit, says consultant

The wealth arms at major banks have endured “substantial brand damage” over the years, which is one of the key reasons some are exiting the advice space, says business consultant Steve Prendeville.

Netwealth gets ‘significant’ buyer interest for Pathway

Netwealth has engaged business consultant Steve Prendeville to sell its Pathway compliance business, which has already received “significant” interest from potential buyers.

Game over for insto-aligned advice

The revelation that NAB has assisted aligned practices to obtain their own AFSLs is welcome news. But it also proves the jig is up for institutional control of Australia's advice practices.

Non-aligned licensees face ‘Trojan horse’ danger

The migration of advice practices from institutional to non-aligned channels presents a specific challenge alongside the opportunities, says an industry analyst and expert.

Opportunities and challenges in independent exodus

The year ahead will test the mettle of non-aligned dealer groups looking to cash in on the migration of advisers away from the institutional sector.

Forte Dealer Solutions names new director

A former senior manager within the IOOF financial advice network has joined Steve Prendeville’s dealer services consultancy to help match advisers to appropriate licensees.

Mid-tier dealers lack crucial capital, says analyst

The migration of advisers to mid-tier non-aligned dealer groups is an opportunity they may be ill-equipped for, says M&A consultant Steve Prendeville.

Fleeing insto advisers bypass mid-tier

Advisers leaving major institutions to join the non-aligned space are bypassing mid-tier dealer groups, which struggle to maintain an independent culture as they grow, an industry analyst has said.

Australian advisers unprepared for exit

Research from American consulting firm Cerulli Associates has found US advisers are underprepared for their retirement, but an expert cautions that the situation is worse in Australia.

Foreign ownership of financial services

On the sidelines of the AIOFP conference in Tokyo, Japan, M&A consultant Steve Prendeville joins The ifa Show to chat about the increasing influence of foreign buyers in Australian financial services. We discuss some major recent deals, ones on the horizon and the impact for advisers and licensees. We also speak with Malcolm Whitten of Nikko Asset Management about the strategy behind the Nikko AM Australian Share Income Fund.

Private equity players back Fitzpatricks

Financial advice network Fitzpatricks Group has received capital funding from two private equity investors, leading one analyst to tip further deal activity of this kind.

Issue #11 : Market Commentary Financial Year 2017

On the surface, it would appear all is good with rising assets, engaged clients, better businesses and rising profits. However, by drilling deeper we can see this year is a transformational year and significant structural changes are happening or are appearing on the horizon. These changes will forever change distribution and more than likely the dominance of the current incumbents.

Issue #10 : Market Commentary Financial Year 2016

The prevalent theme over the year has been one of compliance. This is the continued over hang from the Commonwealth Bank Financial Planning scandal of 2014 who received an Enforceable Undertaking. Over the last 3 years we have seen Macquarie Bank receive an Enforceable Undertaking, NAB compensate 750 customers $10 to $15m for bad advice and ANZ reimburse 8,500 financial planning clients $30m.

Issue #9 : Market Commentary Financial Year 2015

Forte normally takes a rolling 12 month period to identify market trends but the 2015 YTD is so unusual and trends so marked we will reserve most of our comments to the period of January to June 2015.

Financial services set for turbulent 2015 – January 9th 2015

The financial services landscape will alter significantly in 2015 as offshore interests and domestic private equity players establish themselves, predicts a business broker and consultant. Speaking to InvestorDaily, Forte Asset Solutions managing director Stephen Prendeville – who is the former chief executive of Deloitte Financial Services – said the primary trend throughout the year will be a "mass movement" away from institutionally owned dealer groups.

Elephant in the room Why do financial planning businesses trade at higher multiples than accounting firms?

My last IFA contribution (September 2014) looked at external factors that impact industry valuations. I skirted the elephant in the room – that is, the application of recurring revenue and/or EBIT and the more controversial question of why accounting firms trade at one times and financial planning practices trade at three times.

Legacy the key to practice valuation

The most important element of advice practice valuation is the legacy the business leaves behind, says Forte Asset Solutions director Steve Prendeville.

Advice Practice Values Normalise: Forte

Financial advice practice valuations have returned to their long-term average of three times recurring revenue, says Forte Asset Solutions director Steve Prendeville.

Broker groups to buy into wealth sector

An M&A consultant is seeing increasing interest from large broker groups eager to acquire financial planning businesses.

Prendeville acquires dealer group consultancy

My Dealer Group director Anne Fuchs has been recruited to a full-time position at the AFA, with M&A consultant Steve Prendeville taking over her licensee matchmaking business.

IFA July 2014 – The times they are a changin’

The industry is evolving and savvy operators need to ride the waves of change to maximise the value of their business

Issue #8 : Market Commentary Financial Year 2014

2013 finished with a whimper, however, with a message of hope when the new government's spokesman Arthur Sinodinos made comments indicating delivery of pre- election promises in December. Buyers, buoyed by new confidence, immediately came back to market in 2014, but not sellers, who remained cautiously on the sidelines.

Issue #7 : Market Commentary Financial Year 2013/2014

An artificial Merger and Acquisition freeze was created in Financial Services and the wider community due to political and legislative uncertainty through the period from when Julia Gillard, on the 30th of January 2013, called the election date for September the 14th, followed by Kevin Rudd on June 27th calling the 4th of August. Additionally the date of July 1 2013 was the introduction of the "Future Of Financial Advise ( FOFA)" which caused further stagnation and introversion within our industry.

Issue #6 : Market Commentary for the Calender Year 2013 and Trend Identification for 2014 and beyond

The year for merger and acquisition activity came to a crashing end before it had really begun. When Prime Minister Julia Gillard called the election on the 30th January to be held September the 14th, the market for financial services businesses went into an immediate hold pattern.

SMSF Audit pricing under threat

Accountants will need to move to protect their role in the SMSF sector as auditors come under threat from new technology solutions, according to industry consultant Steve Prendeville.

It’s a buyers market as big guns wind back

"It's the first time in 10 years I've seen an absence of buyers" says Stephen Prendeville, managing director of specialist financial planning practice broker Forte Asset Solutions.

Momentum builds for EBIT valuations

As a broker of advisory practices, I was keenly interested in Rod Bertino’s article on valuations in last week’s Reality Check. My recent experience in the marketplace affirms Rod’s research findings that EBIT valuations are in fact outperforming recurring revenue valuations.

Issue #5 : 2012/13 Financial Year Market Commentary

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu.

Dawn of age of consolidation for financial planners

The revolution reshaping financial services has already produced 10 major takeovers worth more than $14.5 billion, involving thousands of financial advisers and hundreds of billions in funds under management. Reform critics claim it has abandoned more than 30 years of improved consumer choice by sacrificing advisers, created barriers to entry and surrendered more power to the big banks and other powerful conglomerates.

The competitive edge: 10 ideas to help practices survive and thrive

Although competition and change can be a threat, they also bring opportunities. Last month, Financial Planning explored the many challenges buffeting the planning industry. While the outlook was sobering, there are still many causes for optimism.

The 3 keys to getting the best price for your practice

In No More Practice 4, Jim Taggart is on a journey to maximise his earn out following the sale of his practice to Austbrokers. A key part of my role in the show involves brokering the deal and advising Jim along the way as he seeks to maximise his earn out.

Like moths to a flame: Facing up to the competition

While they might not be donning running shoes and doing sprint trials, many financial planners probably feel their life is almost as competitive as that of a professional athlete.

Advice M&A to increase

Merger and acquisition activity across Australia's practice and listed advisory sectors is expected to significantly increase this year with buoyant markets enticing advice principals and new entrants to seize opportunities.

Practice sales increasing as confidence improves

Older planners who have been deferring their retirement plans are putting their businesses up for sale as markets improve, according to Forte Asset Solutions director Stephen Prendeville.

Life moves beyond blue for pressured planners

The prolonged lull in investments markets, coupled with the pressure to comply with the new regulatory regime, is taking its toll on some financial planners' mental health.

Volume bans generate creative thinking

Non-aligned dealer groups that are not currently also product manufacturers will need to think creatively to deal with a revenue black hole caused by the removal of volume rebates, according to compliance experts.

Instos may face retention challenge in strong markets

Financial advisers who are viewing institutions as a "safe port in the storm" may be tempted to venture back to a boutique or non-aligned business model when we eventually return to a growth or bull market, according to the Forte Asset Solutions director Steve Prendeville.

Building a profitable business

"Hope is not a strategy." This is how veteran practice consultant, Jim Stackpool from Strategic Consulting and Training, sums up the situation facing financial planners in the brave new FoFA, post-GFC world.

Weak supply boosting valuations: Prendeville

Financial planning practice valuations have returned to three times recurring revenue as weak supply fails to meet demand, according to Forte Asset Solutions director Steve Prendeville.

Issue #4 : 2012 Calendar Year Review

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu.

Issue #3 – Market Commentary

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu.

Financial planners punt on volume rebates

A perception that volume rebates from product issuers to dealer groups will be allowed "in some shape or form" led to a turnaround in practice values at the end of last year, according to Forte Asset Solutions director Stephen Prendeville.

Issue #2 – Market Commentary

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu. Steve was the founding partner of Kenyon Prendeville in 2003 and in May 2011 Steve sought to evolve the business model to the next level and created Forte Asset Solutions. Thank you for your continuing support.

Issue #1 – Introducing Forte Asset Solutions

Forte has retained the database of Kenyon Prendeville and all previous registered buyers information has been maintained to provide ongoing service and communication.

Stressed advisors sell client books

Financial stress and fears about wide ranging regulatory changes have contributed to a doubling of advisers putting their business up for sale during the past 12 months.

FOFA could increase financial planning practice sales further

There has been unprecedented activity over the past 12 to 18 months in terms of practice sales, and it is possible the clarity provided by the latest Future of Financial Advice (FOFA) announcements could prompt a further pick-up leading into the 1 July 2012 implementation date.

Business loan approval tightens

Planning practices looking to expand are finding it increasingly difficult to source funding, as banks tighten their lending criteria amid economic and regulatory uncertainty.

Business Valuation in a FOFA regime – 2011 Extract Market Commentary

The expertise of Forte is forged from the personal experience of Steve Prendeville selling his own national Dealer Group and Financial Planning Business Deloitte Financial Services in 2001 when he was a partner of Deloitte Touche Tohmatsu. Steve was the founding partner of Kenyon Prendeville in 2003 and in May 2011 Steve sought to evolve the business model to the next level and created Forte Asset Solutions.

Mailchimp Coming Soon