About us

We specialise in helping financial service business owners buy, sell and grow through M&A and consulting services.

Gary Wills

Wills Financial Planning

Business sale

I had heard Steve talk at a seminar about the sale of FP practices. I had kept the information on Steve in a file and made contact with him when I was ready to sell. I found Steve to be very professional, ethical and diligent. After providing him with the detailed information he requested, he then proceeded with the sale process. I was expecting this to take 18 month to 2 years. Within a few weeks Steve had a number of ASX listed companies and advisers whom were interested in purchasing my asset. The Sale documents were signed on 6 months later

Dan Walsh

Tailored Wealth

Business sale

Ultimately it was a very positive experience working with the team at Forte. Steve was committed from day 1 to finding the right fit for my business & clients. A sale of any business has its challenges but Steve's processes, experience & communication ensured a smooth journey and positive outcome for all parties. If I were to do it all over again, I would certainly engage Forte Asset Solutions.... because if you are going to do something, do it right.

Andy Gowers

The Taggart Group

Business sale

Having never sold a business before, we were understandably nervous but we received invaluable guidance, support and advice through a lengthy but ultimately worthwhile process. Forte's experienced, steady views on things were fantastic. We have now successfully merged our business with a firm that is an ideal place for our clients and our staff - mission accomplished!

Mark Euvrard

Libertas

Business Sale

Forte’s focus at all time is on the client outcomes or in my case the advisers we looked after. The decision making is a large part on culture and then on the commercial aspects of the transaction. It is not easy to sell your business but it gives great comfort to work with professionals who have networks, processes and understand the marketplace intimately.

Jim Taggart

The Taggart Group

Business sale

I can never thank Steve Prendeville and the Forte team for making such an important decision, seamless enriching and undertaken at a level that was so professional and diligent. Steve is an incredible person, highly intelligent, extremely commercial, sympathetic,and respectful of how businesses are to be bought,sold or merged with the right culture and people. If you are considering any of these particular transactions in your business Steve Prendeville, his staff and business is the organisation to deal with. I cannot recommend them highly enough and I say publicly thank you, thank you, thank you for what you did for me, our business and family.

Anuj Shangle

Time Advice

Business sale

It was fantastic to deal with Steve and his team. We are so happy with the outcome they have managed to accomplish for us.Client care and cultural alignment were the two crucial factors for us. I believe we have not only achieved that but achieved a complete win-win for all the stakeholders involved. It was only made possible with Forte’s ongoing help, patience, systematic approach, professional guidance, and extensive network.I am truly grateful for all the hard work that the Forte team put in to assist us with the transaction and would be very happy to recommend their services to my peers in the industry.

Our Story

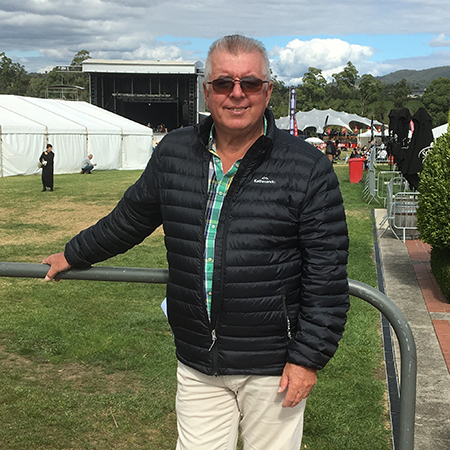

Steve Prendeville

Steve Prendeville

I am the company founder and director of Forte Asset Solutions Pty Ltd (Forte). Forte’s core activity is selling financial services businesses.

I have enjoyed a successful 30 plus year career in financial services. I began my career in New Zealand, then England working first in banking and then in stock broking. In 1987, I became Australia’s youngest certified investment planner (ACIP). My roles included client advice and subsequently senior management.

I established the dealer group National Mutual Financial Planning in Victoria in 1991.

I joined First State Funds Management in 1993 and presided over Victoria’s growth from $40 million pa inward flow of funds to more than $1 billion pa in 1999.

I then accepted a global partnership in Deloitte Touche Tohmatsu, where I held the position Partner, Director and CEO of Deloitte Financial Services (DFS), a national High Net Worth dealer group. After re-engineering the business, I completed the successful sale of DFS in 2001.

After a 12- month sabbatical I came back to the industry and created Australia’s first specialist financial services M & A group Kenyon Prendeville. I co-founded Kenyon Prendeville in 2003. Kenyon Prendeville was the first M&A business specialising in financial services and it went on to be the predominant broker until 2011. I split the partnership in May 2011 to create Forte Asset Solutions Pty Ltd.

Over the last 20 years’ experience, to the best of my knowledge, I have facilitated more than 200 Financial Planning business sales in Australia.

Forte has a database of 6,300 contacts of buyers/seller and Centre’s Of Influence. On a mass mail- out the amount of emails opened ranges from 800-1500, and the number of actions taken from the mailout is approximately 30%.

Forte has 6,000 plus subscribers to our Market Commentary.

I have 2,500 plus Linkedin contacts. The last posted video market update achieved 3,700 views.

Forte website attracts on average 1,800 views per month all primarily seeking businesses for sale.

I am an active media commentator and public speaker on all issues affecting financial services businesses, especially financial planning businesses and Dealer groups.

I have been published in the industries leading publication IFA approx. 9 times in 2019, 2020. Australian Financial Review 3 times in 2020. In 2019 Professional Planner annual review achieved top 10 quotes of the year in. Also published Jan 2020 in Professional Planner.

In the last few years I have been a speaker at the following conferences – AIOFP international conference in Shanghai 2015, AIOFP 2017 Tokyo, AIOFP 2018, New York and Washington and speaker at the AIOFP National Conferences since 2004 (speaker at the national conference for the last 18 years), Independent Financial Advisers Strategy Day 2014/15/17/19/20, AMP Distribution team 2019, IFA Masterfund Conference 2015/2016/2017, Boutique Association Conference 2105/2016/2018, FPA National Congress 2016/2018, AFA National Conference 2017 and many others.

In 2019 I did a white paper commissioned and distributed by HUB24 entitled “Redesigning a practice, a case study “on the ways a MDA can improve business efficiency and profitability. I also participated in a Webinar for TAL August 2019.

I believe I spoke in front of approximately 2,500 advisers in 2019 and similar or greater numbers in 2020 and 2021.

For 2020 I presented at the IFA Strategy day (700 to 800 advisers in total in Brisbane, Sydney, Melb, Perth). Also Futuro national conference before COVID 19 travel limitations.

In May 2020 released a paper titled “Valuations in the middle of a Pandemic” which was sent to our 6,000 subscribers and has received 3,700 Linkedin views and was referenced in IFA daily.

Digitally in 2020 I did a Forte Market Commentary “Valuations in the middle of a Pandemic”

the AIOFP annual conference, Netwealth webinar, My Prosperity webinar, Hub 24 webinar, Shartru Adviser Update and IFA Client Experience Workshop.

In April 2021 I was the opening speaker at the AIOFP Tasmanian national conference and also their December Hunter Valley conference.

In 2021 I conducted webinars for AMP Authorised Representatives Association ‘How to select the best Dealer group for your practice’. I conducted a webinar with Praemium entitled “ Navigating your way to a strong business valuation”. Market overview for Challenger Executive Management team. Spoke at the Hub24 and Myprosperity adviser function and was keynote speaker for the Profession of Independent Financial Advisers Symposium on “M&A trends and selling for top dollar”.

In 2022 I presented for the Challenger Retail Distribution team, at the Affinia conference on Hamilton Island, Lifespan, AIOFP Darwin conference, Sentry Summit conference in the Barossa, IFA Future Forum in Sydney, Dimensional M&A conference and The Adviser Association conference in Sydney. I have also been a guest multiple times on the IFA podcast to discuss the imperative Mental Health Survey released in collaboration with Philippa Hunt as well as the “Future of Financial Services”.

In 2023, I have presented at the Integrated Portfolios Summit, AMP conference and TAL Risk Academy.

I have been a judge for the IFA Excellence Awards every year since 2014 to present in multiple categories –

- Risk Adviser of the Year

- Best New Licensee

- Boutique Group of the Year

- Dealer Group of the Year

- Rookie of the Year

- Boutique of the Year

I have also been a judge for the 2015 to 2023 Australian Accounting Awards in the categories of-

Firm less than $1bn of the Year

Boutique Firm less than $10M of the Year

Diversified Firm of the Year

Partner less than $1bn of the Year

2020 Categories are-

Chief Financial Officer (CFO) of the Year

Corporate Accountant of the Year

Partner of the Year (Boutique Firm of the Year)

Rising Star of the Year

Since 2021 I am also the judge for Women in Finance in multiple categories –

Chief Executive Officer of the year.

Innovator of the year.

Small business adviser of the year.